Atal Pension Yojana (APY) is a flagship social security scheme launched by the Government of India in 2015 with the goal of providing a steady income to citizens after their retirement. Aimed primarily at workers in the unorganized sector, APY ensures financial independence and security in old age. The scheme offers a guaranteed monthly pension of ₹1000 to ₹5000 after the age of 60, depending on the contribution amount. This article provides a comprehensive overview of the APY, covering its benefits, eligibility criteria, enrollment process, contribution chart, tax benefits, and more.

Features of Atal Pension Yojana

| Feature | Details |

|---|---|

| Monthly Pension | ₹1000 to ₹5000 (guaranteed by Government) |

| Age to Join | 18 to 40 years |

| Pension Start Age 60 years | 60 years |

| Contribution Period | Minimum 20 years |

| Bank Account Requirement | Mandatory |

| Government Guarantee | Pension amount guaranteed |

Atal Pension Yojana (APY): What is it?

Pension Fund Regulatory and Development Authority (PFRDA) oversees the government-sponsored Atal Pension Yojana. It was established as part of the government’s effort to increase social security and financial inclusion, and it was named after former Prime Minister Atal Bihari Vajpayee.

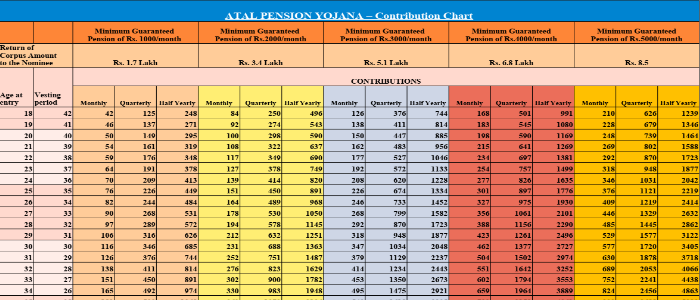

After reaching 60, a subscriber to APY is promised a monthly pension of ₹1000, ₹2000, ₹3000, ₹4000, or ₹5000, contingent on the age at which they joined the plan and the amount of contributions they made.

APY’s goals

- Social Security: Offer a safety net for unorganized sector workers as they age.

- Encourage Savings: Encourage low-income people to develop long-term saving practices.

- Increased Coverage: Give millions of Indians who aren’t covered by EPF or ESIC access to pension benefits.

Who Is Eligible for the APY Scheme?

To qualify for the Atal Pension Yojana, an individual needs to:

- possess Indian citizenship.

- be in the 18–40 age range.

- Possess a savings account (at the post office or a bank).

- Maintain a current Aadhaar card and cellphone number (essential for SMS notifications and account maintenance).

What is the Atal Pension Yojana (APY) application process?

Offline Mode

- Go to the post office or bank that is closest to you.

- Request the registration form for APY.

- Enter your name, Aadhaar number, age, nominee, pension amount, and other information.

Send in using:

- An Aadhaar card copy

- Age verification, if required

- Copy of bank account passbook (if not linked already)

- Each month, the contribution will be automatically taken out of your savings account.

Mode Online (via Net Banking)

- Access your net banking account (for example, SBI, HDFC, Axis Bank, etc.) by logging in.

- Navigate to the section on “Social Security Schemes.”

- “Atal Pension Yojana” should be selected.

- Enter your information and choose the pension amount you want.

- Verify and send in.

How APY Operates: A Basic Illustration

- Assume that 25-year-old Ravi joins APY and desires a pension of ₹5,000 per month when he turns 60.

- Each month, he must pay ₹376.

- From the age of 25 to 60, he will make contributions for 35 years.

- He will receive a pension of ₹5,000 per month for the rest of his life after reaching 60.

- His spouse will get the same pension if he passes away.

- The nominee will receive the accumulated corpus once both die.

What Takes Place If Someone Dies or Leaves?

Subscriber’s passing (before or after age 60):

- The spouse can keep making contributions.

- or get a pension after turning 60.

- The corpus is given back to the nominee following the death of the spouse.

Exiting voluntarily (before 60):

- Not permitted unless there are special circumstances.

- Only contributions—not the government share—are reimbursed, if permitted.

- Before enrollment is finished, the subscriber passes away:

- The nominee has received their contributions back to date.

- Atal Pension Yojana (APY) subscribers are eligible for the following tax benefits:

- deduction under Section 80C of up to ₹1.5 lakh.

- Section 80CCD(1B) allows for an additional deduction of up to ₹50,000.

- Both self-employed and salaried people can use it.

The government’s role in APY

- The pension amount is guaranteed by the government.

- The government used to give ₹1000 annually (for those customers who joined before March 2016).

- Guarantees that the pension is credited each month following retirement.

Atal Pension Benefits Yojana Guaranteed Pension:

- Post-retirement financial stability.

- All income levels may afford the low monthly contribution.

- Lifelong benefits are guaranteed by the government.

- Payment dates don’t need to be remembered thanks to the auto debit facility.

- Tax Savings: 80CCD(1B) Deduction.

- Spouse Coverage: After a subscriber passes away, their spouse receives their pension.

- Wealth Transfer: Following the death of the subscriber and spouse, the nominee receives corpus.

Questions and Answers (FAQ)

1. Is it possible to have both APY and NPS?

Indeed. Both the National Pension System and the Atal Pension Yojana are open to subscribers.

Q2. Does applying for APY need having Aadhaar?

Although not required, it is highly advised. Aadhaar facilitates simple connection and identification.

Q3. Will I be able to alter my pension later?

Indeed, you have the option to change the pension amount once per a fiscal year.

Q4. What occurs if a contribution is missed?

There is a minor penalty: A payment of ₹1 up to ₹100 Between ₹101 and ₹500, ₹2 5 naira for 501 to 1000 naira, Over ₹1001, it’s ₹10.

Q5. How secure and safe is APY?

Indeed. It is supported by the Indian government and governed by PFRDA.

Conclusion

One effective program that aims to guarantee that even the poorest Indian workers can live with dignity after retirement is the Atal Pension Yojana (APY). With guaranteed returns and low monthly contributions, APY helps people in the unorganized sector fill the pension gap. Any Indian citizen between the ages of 18 and 40 has a fantastic opportunity to get started early and create a safe future.

If you are qualified and haven’t joined yet, now is the ideal moment to apply for the ₹5000 monthly pension plan and start along the path to retirement financial independence.