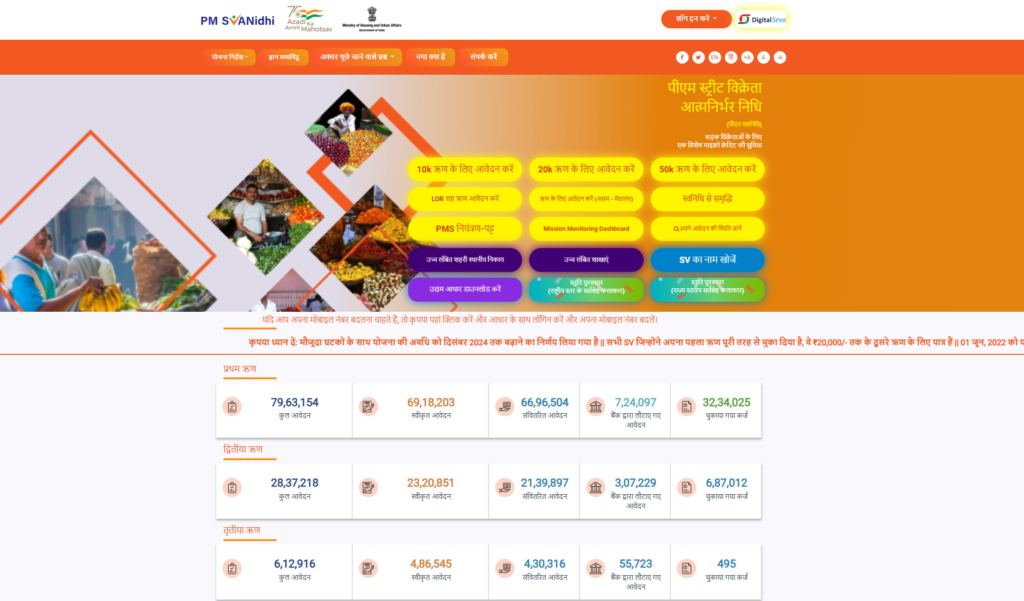

PM SVANidhi Scheme is a revolutionary financial support program launched by the Government of India to empower street vendors affected by the COVID-19 pandemic. Launched on June 1, 2020, this scheme aims to provide collateral-free loans up to ₹50,000, helping vendors resume and expand their livelihoods. PM SVANidhi is more than just a loan scheme — it is a step towards financial inclusion, digital empowerment, and economic upliftment of millions of street vendors across the country.This article explains in detail the objectives, features, eligibility, loan amounts, benefits, application process, documents required, FAQs, and more about this important scheme.

Key Features of PM SVANidhi Scheme

| Feature | Description |

|---|---|

| Scheme Name | Pradhan Mantri Street Vendor’s AtmaNirbhar Nidhi |

| Launch Date | 1st June 2020 |

| Ministry | Ministry of Housing and Urban Affairs (MoHUA) |

| Beneficiaries | Street vendors (urban and rural) |

| Loan Amount | ₹10,000 → ₹20,000 → ₹50,000 (in 3 tranches) |

| Interest Subsidy | 7% on timely/regular repayment |

| Loan Tenure | 12 months (for each loan) |

| Digital Transaction Incentives | Cashback of ₹100/month (maximum ₹1,200/year) |

| Collateral Requirement | None (Collateral-Free) |

| Credit Bureau Rating | Positive impact for future larger loans |

| Application Mode | Online (via portal or app) and offline (through banks/ULBs) |

| Implementing Agencies | Scheduled banks, NBFCs, MFIs, cooperative banks, ULBs |

What is PM SVANidhi Scheme?

The PM SVANidhi (Pradhan Mantri Street Vendor’s AtmaNirbhar Nidhi) is a Central Sector Scheme launched by the Ministry of Housing and Urban Affairs (MoHUA). It facilitates working capital loans to street vendors to restart their businesses, which were adversely affected due to the COVID-19 lockdown.

The scheme provides:

- Collateral-free working capital loan of ₹10,000 (1st tranche)

- ₹20,000 (2nd tranche), and ₹50,000 (3rd tranche)

- Incentives for timely repayment and digital transactions

Objectives of PM SVANidhi

- Empower Street Vendors: Help them resume businesses post-pandemic.

- Offer Easy Loans: Provide easy, low-interest, collateral-free working capital loans.

- Promote Digital Inclusion: Encourage vendors to adopt digital payments.

- Formal Financial Access: Bring vendors into the formal banking ecosystem.

Who is Eligible for PM SVANidhi?

Eligible applicants include:

✅ Street Vendors who:

Have vending licenses or are identified in the survey conducted by ULBs (Urban Local Bodies)

- Belong to urban, semi-urban, and rural areas

- Were vending as on or before 24 March 2020

- Are part of SHGs, JLGs, or self-employed vendor groups

Documents Required

- Aadhaar Card

- Voter ID Card

- Vendor Certificate (if available)

- Bank Account Details

- Passport-size Photograph

- Mobile Number Linked to Aadhaar

- Any one proof of vending:

- Letter of Recommendation from ULB

- Identity card issued by urban vendor associations or NGOs

Loan Amount and Repayment Terms

| Loan Tranche | Maximum Amount | Repayment Tenure | Interest Subsidy | Digital Cashback |

|---|---|---|---|---|

| First Loan | ₹10,000 | 12 months | Yes (7% p.a.) | Yes (₹100/month) |

| Second Loan | ₹20,000 | After repaying 1st loan on time | Yes | Yes |

| Third Loan | ₹50,000 | After repaying 2nd loan on time | Yes | Yes |

Interest Subsidy and Cashback Benefits

- 7% Interest Subsidy:

- Credited quarterly to the vendor’s account.

- On timely repayment only.

- Digital Transaction Cashback:

- Monthly cashback up to ₹100 (using BHIM, Google Pay, PhonePe, etc.).

- Up to ₹1,200 per year.

How to Apply for PM SVANidhi Scheme?

Online Application Process:

Visit: https://pmsvanidhi.mohua.gov.in

- Click on “Apply for Loan”

- Enter your mobile number linked with Aadhaar

- Fill the application form

- Upload the required documents

- Choose your preferred bank/lender

- Submit and note the Application ID

Important Link

| Official Website | Click Here |

| Offline Loan Application Form | Click Here |

Via Mobile App:

- Download PM SVANidhi App from Play Store.

- Follow the same steps as above.

Offline Process:

Visit your nearest:

- Municipal Office (ULB)

- Bank branch (e.g., SBI, PNB, HDFC)

- Fill the PM SVANidhi form manually.

- Submit it with photocopies of required documents.

Banks Participating in PM SVANidhi

More than 1,100 banks and NBFCs are enrolled under the scheme including:

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Bank of Baroda

- HDFC Bank

- ICICI Bank

- Regional Rural Banks (RRBs)

- Cooperative banks

- Microfinance Institutions (MFIs)

Benefits of PM SVANidhi Scheme

✅ No Collateral Required – Truly unsecured loan for street vendors.

✅ Low Interest + Government Subsidy

✅ Digital Empowerment – Vendors encouraged to use UPI/QR codes.

✅ Improves Credit History – Helps get future bigger loans.

✅ Social Upliftment – Supports micro-entrepreneurs.

✅ Flexible Application – Online and offline modes available.

✅ Access to Government Support – Potential linkages to other social welfare schemes.

PM SVANidhi Se Samriddhi Program

A special drive under PM SVANidhi to:

- Collect socio-economic details of beneficiaries

- Facilitate their inclusion into:

- PM Jan Dhan Yojana

- PM Jeevan Jyoti Bima Yojana

- PM Suraksha Bima Yojana

- PM Awas Yojana

- One Nation One Ration Card, etc.

Frequently Asked Questions (FAQ)

Q1. Can rural vendors apply for PM SVANidhi?

Yes. Vendors from both urban and rural areas can apply if they meet the eligibility criteria.

Q2. What is the repayment tenure?

Each loan tranche (₹10,000, ₹20,000, ₹50,000) is repayable in monthly installments over 12 months.

Q3. Is there any processing fee?

No, there are no processing fees charged by banks or the government.

Q4. Can a vendor apply without a vending certificate?

Yes. A Letter of Recommendation (LOR) from the Urban Local Body can be submitted instead.

Q5. What happens in case of default?

Late payment can impact credit score and delay eligibility for the next loan tranche or subsidy benefits.

Q6. Can I check the status of my loan application?

Yes. Visit the PM SVANidhi portal and use your Application ID to track your status.

Conclusion

The PM SVANidhi Scheme is a transformative initiative that empowers over 50 lakh street vendors in India with financial freedom, security, and digital inclusion. With no collateral required, easy repayment terms, and government-backed incentives, this scheme is tailor-made to revive and uplift the street vending economy.

If you’re a street vendor or know someone who is, PM SVANidhi is a golden opportunity to rebuild your business, grow with digital tools, and access formal finance. Apply today and take a step towards AtmaNirbharta