Sukanya Samriddhi Yojana-Short Notification

|

Sukanya Samriddhi Yojana (SSY) Overview

In order to safeguard a girl child’s future, the Sukanya Samriddhi Yojana was introduced, with a primary focus on the costs of her education and marriage. The plan is a desirable choice for parents or guardians to save for a girl child’s future because it gives a higher interest rate than traditional savings accounts. SSY participates in the Beti Bachao Beti Padhao program, a nationwide effort to solve concerns pertaining to girls, support their education, and guarantee their financial independence.

Important Points to Remember:

-

Government-backed: The program is a safe investment choice because it is a government initiative and delivers guaranteed returns.

-

Tax Benefits: Section 80C of the Income Tax Act allows for tax deductions for contributions made to SSY, and interest received is likewise tax-exempt.

-

Attractive Interest Rate: Among government savings plans, the interest rate provided by SSY is among the highest.

|

Sukanya Samriddhi Account Eligibility

The requirements for establishing a Sukanya Samriddhi Account are quite simple:

-

Girl Child: Only a girl child may open an account in her name. Its goal is to help a girl secure her future.

-

Age Requirement: When opening an account, the girl kid must be under ten years old. The girl child will not be allowed to open the account if she is already ten years of age or older.

-

Guardian Requirement: The parent or legal guardian of the child may open the account. The account can be continued by the surviving parent or guardian in the event that one of the parents passes away.

-

Number of Accounts: Each girl kid may open one Sukanya Samriddhi Account. Subject to specific restrictions, parents of twins or triplets are permitted to open numerous accounts.

|

Sukanya Samriddhi Yojana characteristics

For parents or guardians of a girl child, the Sukanya Samriddhi Yojana is a distinctive and alluring investment choice because of its many advantages.

a) Rate of Interest

- Among government programs, the Sukanya Samriddhi Yojana offers one of the highest interest rates. The interest rate is 7.6% annually as of the current fiscal year. The Indian government has the authority to alter this rate every three months. In contrast to conventional savings accounts or fixed deposits, the rate is still somewhat high.

b) Investment Caps

- Minimum Deposit: To maintain the Sukanya Samriddhi Account open, a minimum of ₹250 must be deposited each year.

- Maximum Deposit: ₹1.5 lakh is the maximum annual deposit. Parents may make deposits in multiples of ₹100, but they cannot make more than ₹1.5 lakh in a single year.

c) Maturity and Duration

- Account Maturity: 21 years from the date of account opening or, if the girl marries after turning 18, whichever occurs first, the Sukanya Samriddhi Account matures.

- Partial Withdrawal: Up to 50% of the account balance may be taken out in part for further education after the girl child turns 18. Only after the girl reaches the age of eighteen can she withdraw for marriage.

c) Tax Advantages

- Tax Deduction: Up to ₹1.5 lakh in tax deductions are available for contributions made to the SSY account under Section 80C of the Income Tax Act.

- Interest Tax Exemption: There is no tax on interest received in the Sukanya Samriddhi Account.

- Tax Exemption for Maturity Amount: The money received at maturity is likewise exempt from taxes.

e) Early Termination

- In some circumstances, the account may be closed early:

- Death of the Account Holder: Should the girl child pass away, the account will be closed and the remaining amount will be given to the heir.

- Emergency: The account may be closed early if the guardian experiences actual financial difficulties or if the girl marries after turning 18.

|

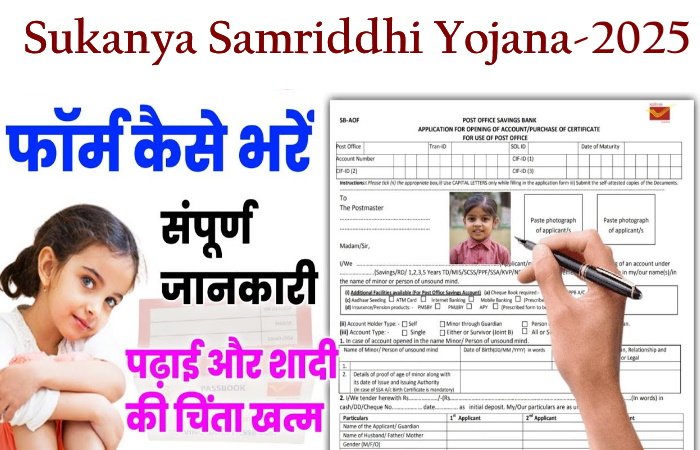

How to Create an Account on Sukanya Samriddhi

The process of creating a Sukanya Samriddhi account is easy and straightforward. It can be completed at any recognized bank or post office in India. Here is a detailed guide:

a) Documents Needed

- Verification of the Guardian’s Identity and Address: valid documents such as a driver’s license, passport, voter ID, or Aadhar card.

- The girl child’s birth certificate, which must be shown when creating an account, serves as proof of birth.

- Picture: A passport-sized picture of the guardian and the girl child.

b) Procedure

- Visit a Bank or Post Office: Proceed to the authorized bank branch or post office that provides SSY accounts, if it is nearby.

- Complete the application: Fill out the application form completely and accurately.

- Send in Documents: Send in the necessary paperwork, such as a passport-sized photo, proof of identity, and the girl child’s proof of birth.

- Deposit the Initial Amount: To activate the account, make a ₹250 minimum deposit.

- Get the Passbook: A passbook for the Sukanya Samriddhi Account will be sent to you once the requirements are finished. All deposits, interest, and withdrawals will be recorded in this passbook.

|

Sukanya Samriddhi Account Benefits

Creating a Sukanya Samriddhi Account for your daughter has the following benefits:

a)High rates of interest

- The SSY offers higher yields than many other government savings plans and fixed deposits, with a current interest rate of 7.6%.

b) Governmental Assure

- The Government of India supports the SSY, which makes it a trustworthy and secure investment choice. The principal is secure, and even though the interest rate is changed every three months, it remains competitive.

c) Returns Without Taxes

- The plan is a great choice for long-term investments because it gives tax-free interest and a tax-free maturity amount.

d) A Girl Child’s Financial Security

- The SSY guarantees that the money is utilized exclusively for the girl child’s education and marriage. Because it covers two significant expenses that could otherwise deplete funds, this targeted financial security can be a big relief to parents.

e) Contribution Flexibility

- The program offers flexibility with regard to the maximum contribution amount (as long as it doesn’t surpass ₹1.5 lakh per year) and the maximum contribution period (until the girl is 14).

g) Withdrawal in Part

- After the girl turns 18, she can take out partial withdrawals from the account to fund her education or other personal expenses.

|

Sukanya Samriddhi Account Drawbacks

The Sukanya Samriddhi Yojana provides a number of benefits, but it also has several drawbacks.

a) Extended Lock-in Time

- The plan may not be appropriate for people who demand quick access to money because it requires the account to be maintained for a lengthy time (21 years).

c) No wiggle room for withdrawals

- The plan limits withdrawals to specific events, such the girl’s marriage or graduation. Additional emergency withdrawals are not covered.

d) Age Limitation

- This program is only available to children under the age of ten, which limits some parents’ or guardians’ interest in it.

|

IMPORTANT LINK

Official Notification

|

|

Official Website

|

|

|

Conclusion

Without a doubt, one of the greatest savings plans in India for ensuring a girl child’s financial future is the Sukanya Samriddhi Yojana. It is a government-supported program that guarantees the funds are used for the girl child’s wellbeing and provides great profits and tax advantages. Despite a few restrictions, the benefits greatly exceed the disadvantages, particularly when considering the long-term objective of funding the female child’s education and marriage. The Sukanya Samriddhi Account is a great option for parents who want to save for their daughter’s future in a method that is safe, dependable, and tax-efficient. Parents can make sure they have enough money when their daughter most needs it by starting an SSY account early. |